Rye Ranks Tops for Taxes, Culture and Recreation – New Report

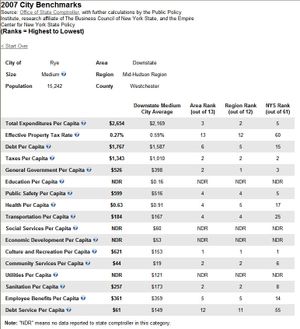

The Empire Center for New York State Policy, a conservative think tank, has published a new database that shows Rye City has the second highest tax rate of the 61 cities in New York State. Rye's taxes per capita are $1,343 vs. the "Downstate Medium City Average" of $1,010.

Rye has one of the lowest effective property tax rates of 0.27%, ranking the second lowest in the state–#60 of 61 cities. Rye also ranks #1 of 61 cities in spending for culture and recreation per capita–spending $621 vs. $153 for the "Downstate Medium City Average". All data is from 2007.

See the chart above or search the database yourself.

Tell us what you find interesting by leaving a comment below.

Well, there are cities and there are “cities”. Although Rye is a city, I don’t think we can really compare it to Rochester, White Plains, etc., still this is a handy bit of info and a nice website to refer to.

Thanks for posting the information!

Now given our 2nd highest taxes ranking, you would hope our elected representative in Albany gets us some relief from these crushing state income taxes. But you would hope in vain. Thank You Rye Record for the following piece of outrageous nonsense that just escaped from her lips –

“State Senator Suzi Oppenheimer, who voted for the entire package of spending and tax increases, told the paper: “There are parts of the budget that would not be of my choosing, but I support the positive actions that were included.” Oppenheimer praised parts of the budget for the “restoration of education aid that was more helpful to Westchester. In addition, we were able to keep the STAR exemption program intact.” Oppenheimer said she worked to prevent cuts to Valhalla Medical Center; and that she sought “mandate relief and paperwork reduction to lower costs for schools,” but such measures were not included in the final budget. The state budget did eliminate the STAR rebate program, canceling about $1.7 billion in rebate checks to homeowners.”

So she VOTED FOR ALL THE TAX INCREASES, couldn’t protect much of anything locally from SERVICE CUTS, didn’t even know that the homeowner STAR rebates had been ELIMINATED and now is going to champion redistributed school aid as what we should be thankful for and what we pay her for?

If this is all true then I’ve got a bridge to sell her right away. Better yet, let’s have Mr. Shew call in the White Plains evaluation squad on her pronto!

And this morning another good piece about our dysfunctional state politicians. This one is the lead editorial in today’s Wall Street Journal and its title is “The Tax Capital of the World – States are raising taxes despite the ‘stimulus’; New York is No. 1.” I don’t want to get our host Jay in any trouble so I will not copy it verbatium but ask if he would consider getting their (The WSJ) permission to link to it or copy it out full from behind their online paywall.

Here’s a teaser –

“This is advertised as a plan of “shared sacrifice,” but the group that is most responsible for New York’s budget woes, the all-powerful public employee unions, somehow walk out of this with a 3% pay increase. The state is receiving an estimated $10 billion in federal stimulus money, and Democrats are spending every cent while raising the state budget by 9%. Then they insist with a straight face that taxes are the only way to close the budget deficit.”

Thanks Ted. I hope it is AOK to post a link. I don’t subscribe to the Wall Street Journal but easily accessed this story online here: https://online.wsj.com/article/SB123940286075109617.html

It is rather depressing news, even for those of us who aren’t in that “millionaire tax” bracket.

To shift gears a little, I received a notice from COngresswoman Lowey today congratulating herself on getting Rye City School District $389,000 of federal stimuls money of which $364,000 was for IDEA programs. This raises a few points: (1) What makes an elected official think they deserve any credit for sending us back our own money? I am glad Rye is getting the money, but I would have been just as happy if we weren’t taxed by Washington only to have them give some of it back to us. (2) We are spending $364,000 on IDEA programs? (For those that don’t know, that is for disabled students). While we should be educating all children, disabled or not, this is a lot of money to spend on the handful of disable students in Rye City. Of course, we’ve changed the definitions, so that every kid is disabled in some way. (3) Why is Cong. Lowey taking credit for giving Rye money to comply with the requirements she and the rest of Congress imposed on us in the first place? If I was king, I would require every level of government that imposed a requirement on another level of government to fund the sosts of that requirement. You mandate it, you pay for it. Then you can take all the credit or blame for your actions. I would also adopt Pres, Obama’s restrictions on salary and apply it to Congress by limiting their pay to an annual rate equal to twice the poverty level or the average salary in their district/state. That would incentivize Congree to grow household incomes and realize how the poor really live. For those who are elected to State and local office, I would abolish all salaries and perks. Make their service truly public service and insure that no one would want to serve forever. But alas, I am not king, but, like Mongo, a pawn in the game of life.

“But alas, I am not king, but, like Mongo, a pawn in the game of life.”

Are you really Mel Brooks? That was very funny.

No I am not Mel Brooks. But I could be Mongo (sans beans).