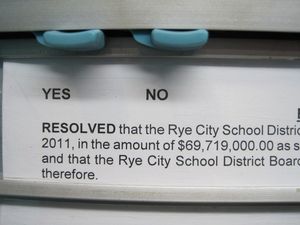

Rye City School Budget Passes, Egan and Glassberg Win Uncontested in Low Turnout

Polls closed at 9pm tonight and the results are in for the Rye City School Budget and the Board Candidates:

Rye City School Budget: Passed

Yes Votes: 929; No Votes: 652

The two seats on the Board of Education were uncontested:

Kendall Egan: Winner 1,212 Votes

Katy Keohane Glassberg: Winner 1,170 Votes

If we combine the yes and no votes for the budget (not necessarily accurate, but close), only 1,581 people voted out of 10,076 voters eligible to cast ballots in today's election – a paltry 15.69% voter turn-out.

I am very happy that the budget passed. The board did a great job at keeping the tax rate as low as it is without sacrificing our children. I hope the teachers contract comes next. It is only right and fair that they get a contract.

Kendall Egan, Katy Glassberg, Laura Slack, Young Kim – 4 out of 7 BOE members are former PTO heads. Do not mistake the PTO as a noble institution. It delivers the budget vote for Ed Shine and you’ll find special interests and elite entitlement trumping community values.

The remaining 3 members of the BOE are parents with children in the district. Most in elementary or middle school.

Yet an overwhelming majority of residents in Rye do not have children in the district. The percentage of parents with school-age children who choose educate their children outside of the RCSD is substantial. Ed Shine talks a good game when it comes to respecting all the “stakeholders” but….

So why isn’t there a stipulation that the BOE should represent the demographics of the town of Rye?

To get the news out, I’m posting a shortened version of the District’s PR…

APPELLATE COURT RULES IN FAVOR OF RYE CITY SCHOOL DISTRICT,

HOLDS THE OSBORN HOME 100% TAXABLE

The Appellate Division of the Second Judicial Department of the Supreme Court of the State of New York on October 12, 2010, found in favor of the Rye City School District and holding The Osborn to be 100% taxable and rejecting The Osborn’s claim to a 100% charitable exemption and reversing the 2007 lower court’s partial exemption.

The Appellate Court found the total tax value for the years 1997-2001 was correctly assessed. The Osborn owes the District additional tax monies because the prior partial exemption was improper. The Osborn is owed a refund for overpayment of property taxes for the years 2002 and 2003. (To avoid having to pay interest on the refund it would be required to make if the trial court’s valuation decision was upheld on appeal, The Rye City School District previously paid The Osborn the School District’s portion of the refund The Osborn would be due based on the trial court’s valuation decision.) The Appellate Court remanded the matter to the trial court to calculate the amount of the refund for 2002-2003 and the amount of the taxes owed by The Osborn for the years 1997-2001.

What I’d like to quickly see from the District is:

> Estimate of the amounts due from The Osborn to the District because of the charitable exemption reversal

> Estimate of the amounts due from the District to The Osborn to reflect the property valuation confirmation

> Clear statement of the required level of the Tax Cert fund given the resolution of the case and the clarity brought to The Osborn’s subsequent tax cert filings for years after 2002.