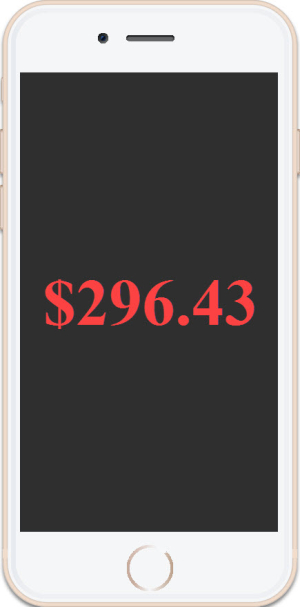

Jeopardy Answer: $296.43 The Question: If You Own a $2 Million Home, What is the Impact of The Westchester County Property Tax Levy Reduction?

Westchester County has announced the City of Rye’s Westchester County Property tax levy portion is $35,895,395 million dollars, down 4.66% or $1,753,578 million dollars, as part of the 2020 county budget, passed with the help of Rye guy and Westchester County Executive George Latimer.

Now, we asked Latimer’s office what the impact is to an average Rye citizen.

SHORT ANSWER: you save $296.43

SLIGHTLY LONGER ANSWER: For a $2 million home (recent homes sale prices average around $1.9 million) , the assessed value would be $30,600. So you multiply the County Tax Rate of 207.88 by 30.6 (Tax Rate is always expressed as per $1000 of Assessed Value)=$6,361.13. Now, take 4.66 % of that and it is your savings=$296.43

We also asked Latimer’s office what percentage of your taxes are county vs. city vs. school. The answer depends on the school district.

RYE CITY: In the Rye City School District the County portion of the taxes amounts to 19.25%. The City of Rye taxes amount to 16.37% and the School Taxes are 59.29%

RYE NECK: In the Rye Neck School District the County portion is 14.47%, the City 12.3%, and the School taxes are 69.4%

Thanks to Joe Sgammato in Latimer’s office for helping us track all this down. And here is the full news release:

WESTCHESTER COUNTY PROPERTY TAX LEVY REDUCED BY 4.66% IN THE CITY OF RYE

(Rye City, NY) – In the 2020 Budget Westchester County, the City of Rye’s Westchester County Property tax levy portion is $35,895,395, down 4.66% or $1,753,578, thanks to Westchester County Executive George Latimer and his work on the passage of the Westchester County Property Tax Payer Protection Act.

Latimer said: “We made a commitment to freeze County property taxes, and we were able to go a bit further and cut the County’s property tax levy by $1 million. This cut impacts each community differently. I’m pleased the people of the City of Rye were able to see a reduction in their County property tax bill of nearly 5%. This budget is about the people who live in Westchester County, it is about giving them some property tax relief, and at the same time working to make their County the best it can be – by providing services and programs taxpayers rely on while placing the County back onto solid financial ground.”

This is the first time, in almost a decade that a County Executive has proposed and implemented a budget that reduces the County property tax levy. Focused on taking the burden off Westchester County property taxpayers and combating the loss of the federal SALT deduction, Latimer called for the passage of the Act which is slated to bring in an estimated $140 million dollars annually. Of the $140 million 30% of new revenues is being shared back to local governments and school districts to assist their budgets and tax relief efforts. The 30% amounts to over $40 million helping to provide additional property tax relief.

Rye City Mayor Josh Cohn said: “I am sure all the residents of the City of Rye are very happy to see the effect of the County’s tax restraint, especially given the diminished Federal tax allowance for SALT. The City is grateful as well for the sales tax benefit that the County is sharing with us.”

Along with, cutting County’s Property Tax levy by $1 million dollars, the County was able to put money into the reserve fund, end the reliance on one-shot revenues, end borrowing for operating costs and most significantly create sales tax parity across all of Westchester’s communities, bringing the rate in line with other counties including Rockland and Putnam, and other cities including White Plains, Mount Vernon and New Rochelle. The new countywide standard rate of 8 3/8% is still lower than that in effect in Yonkers, New York City, Nassau and Suffolk Counties.