Your Money: City of Rye 2021 Citizens Budget Report

Welcome to the City of Rye 2021 Citizens Budget Report

The following report is prepared annually by the City of Rye Finance Committee in conjunction with the City Manager and City Comptroller. The purpose of the report is to provide an overview of the 2021 Tentative Budget, along with comparison to recent years. The categorization of revenues and expenses may differ from those of the formal budget.

The Finance Committee members are James Jenkins (Chair), Fred Buffone, Sam Dimon, William Gates, Christine Groves, John Hunt, Susan Watson, Jon Peters, Jim Sandling and John Souza. The City Manager is Greg Usry and the City Comptroller is Joseph Fazzino.

For a more complete understanding of the 2021 Budget please refer to the City Comptroller presentation of November 4, 2020 along with the Tentative Budget.

Full documents are available at the end of this page.

Key Dates for the 2021 Budget:

- November 17 & 23 – City Council Workshops (open to the public via zoom);

- December 2 – City Council Meeting (Public Hearing on Budget);

- December 16 – City Council Meeting to vote on 2021 Budget Overview of the 2021

Tentative Budget proposal from the City of Rye staff:

- The proposed 2021 Stated Property Tax Rate is $187.60 per $1,000 assessed valuation, a 4.2% increase over the 2020 tax rate;

- The tentative budget provides a tax levy increase for 2021 of $1.2 million ($47 thousand less than the NYS Mandated Tax Cap);

- The Annual Property Tax Bill is an increase of $178 per average household.

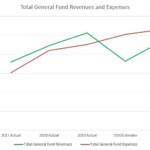

- Total General Fund Revenues are budgeted to be $39.4 million or 5.8% higher than the 2020 estimate;

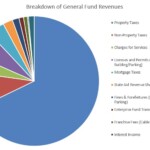

- The Proposed 2021 Property Tax Levy is $26.5 million, or 4.8% over 2020;

- Other Revenues (consisting of Non-Property Taxes, Permits, Fines and other) are budgeted to be $12.9 million or 8.0% higher than the 2020 Estimate. The 2021 budget includes an increase in Sales tax of $200 thousand in part as the County increased the sales tax rate by 1% in August 2019;

- Building activity declined in 2020 for the second consecutive year. The 2021 budget is conservatively forecast as flat as an uptick in activity is expected in 2021.

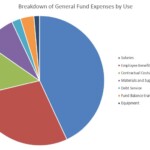

- Total General Fund Operating Expenditures are budgeted to be $39.2 million, or 1.5% over the estimated 2020 level. Capital Expenditures of $950 thousand are not included in operating expenditures;

- The 2021 budget of employees cost is $3.2 million or 12.5% higher than the 2020 forecast, largely as a result of a hiring freeze implemented in May due to the pandemic. These are budgeted to be filled in 2021;

- The increase in employees cost was offset by a decline of $706 thousand in financing and debt service cost;

- The 2021 deficit of $1.2 million is a planned use of General Fund Balance to Fund Capital Expenditures, miscellaneous equipment purchases and contingency costs, including $425 thousand dedicated to fund capital improvements;

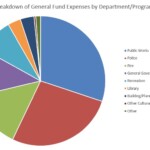

- There will be $1.65 million dedicated to Street Resurfacing in 2021;

- $350 thousand is being transferred to the City’s Capital Reserve account, bringing the total balance to roughly $5.5 Million;

- The projected 2021 General Fund Unassigned Fund Balance is estimated to be $4.05 million, or 10.1% of Total 2020 Expenditures.

Full reference documents / full reports:

- City of Rye Citizens Budget Report FY 2021 vFinal Revised – PDF version

- City of Rye Citizens Budget Report FY 2021 vFinal Revised

- 2021 Budget Presentation

- 2021 Tentative Budget

- 2021 Budget Overview Fact Sheet