Assessor’s Property Records Entering 21st Century

updated 2/13/23 to clarify how a property is assessed

The City of Rye Assessor’s Office is entering the 21st century.

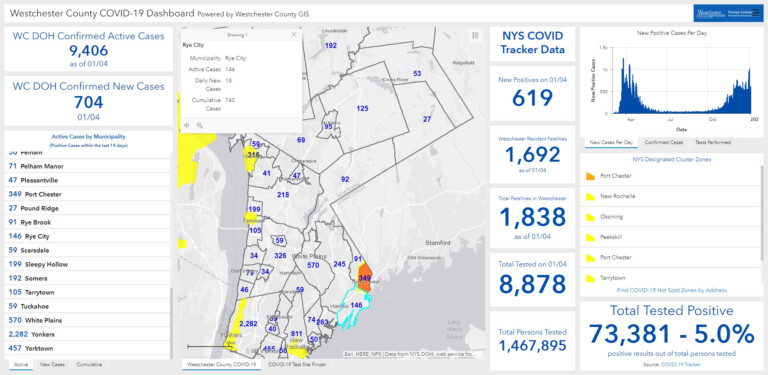

Found in the basement of City Hall, the assessor’s office serves the vital function of tracking the 5,200 private and commercial land parcels that compose the six square miles that make up the City. The records – contained on paper “property cards” – contain all the elements that the assessor uses to determine a property’s value.

It is this value that is combined with the equalization rate (1.47% for 2022) that determines the new assessment for new construction and improved properties. For example, for a new $2.5 million dollar home, the property assessment would be $36,750 ($2,500,000 x 1.47%). Thus, the assessment x 2022 tax rate = annual real estate taxes (36,750 X 1098.88/1,000 = $40,384) (see note 1 and note 2).

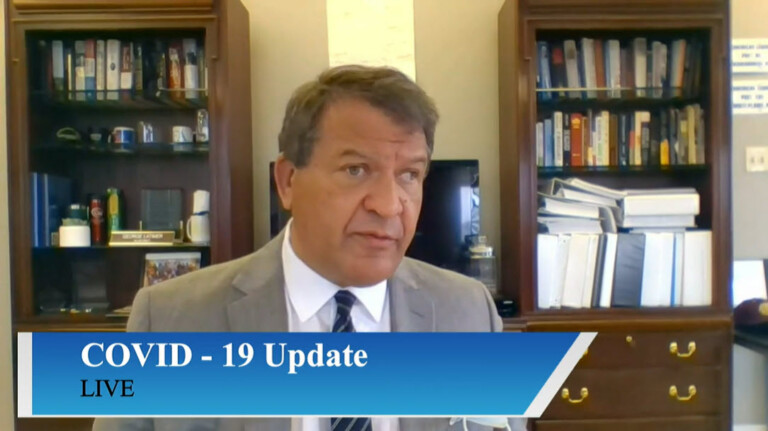

We sat with Rye City Assessor Patrick McEvily and Assistant Assessor Jon Flynn to learn a bit more about the project and their goal to maintain an equitable assessment role to make sure the tax burden is divided equally among taxpayers.

Property Cards

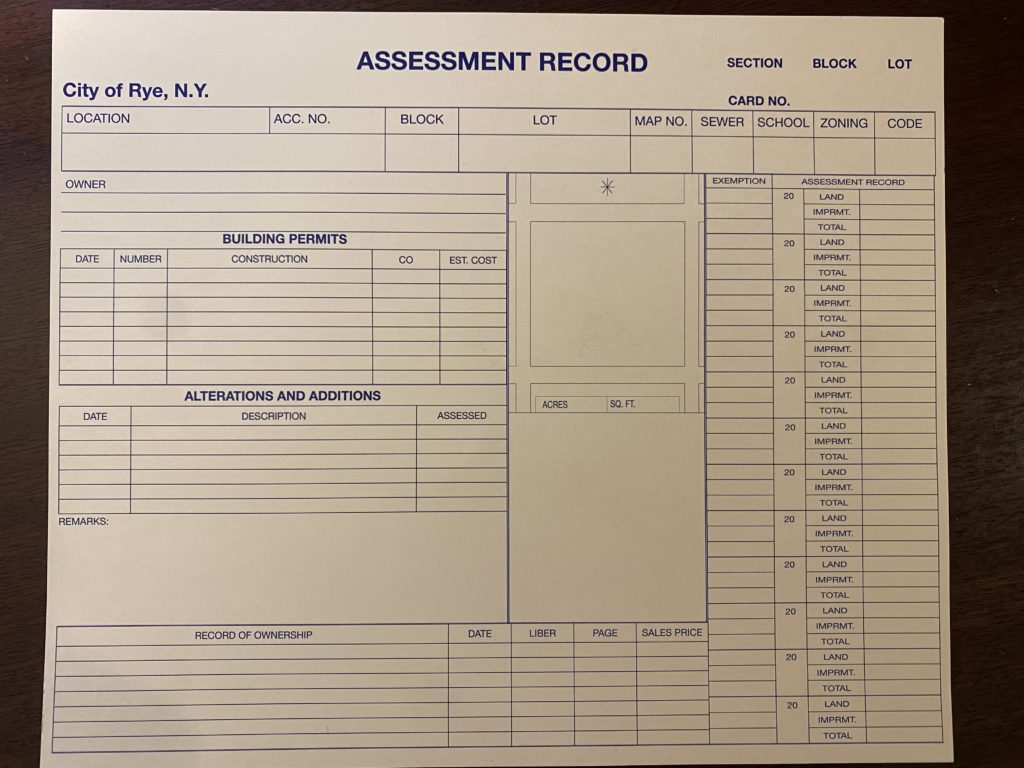

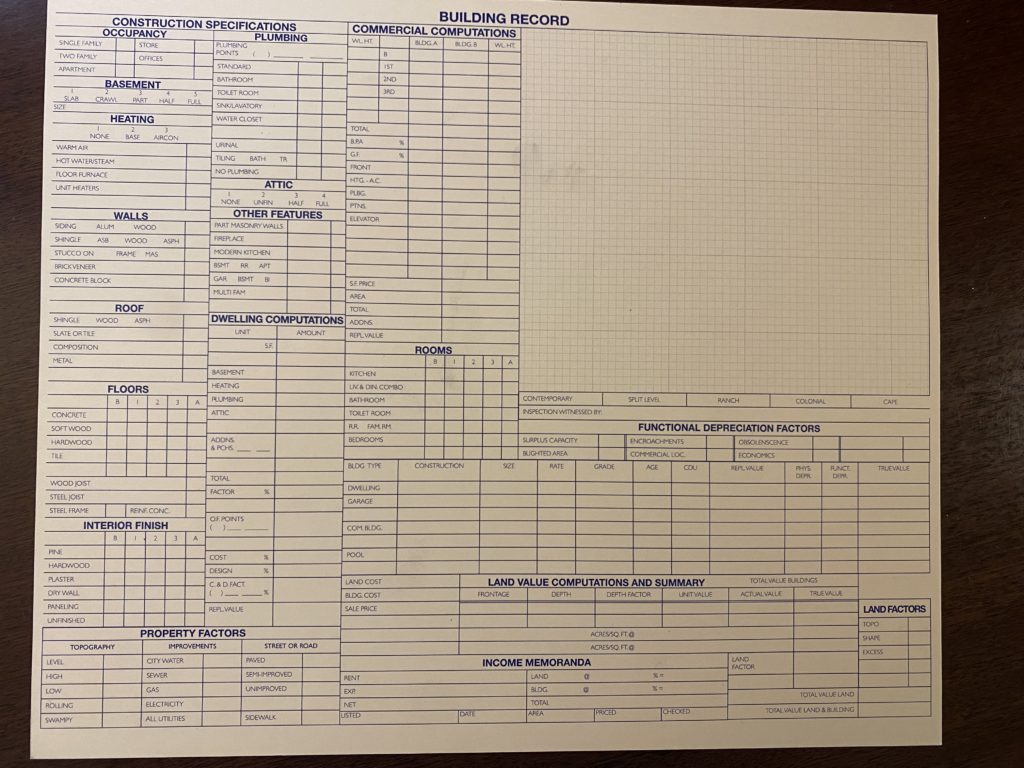

Each property card is the tan-ish color of a manila file folder and on its two sides contains hundreds of handwritten data points including permits, alterations and additions, ownership records and various home or land attributes such as square footage, house systems, topography, road access, room counts and depreciation factors. The current property cards have records back to the 1972 revaluation (the last time there was a citywide revaluation), although the assessor has some cards that date to the 1950s. Cards are updated with any improvement that adds to market value.

These cards have been sent to Gar Associates in Albany to be scanned and added to their searchable PROS Property Records On-line System. There will also be photos and land surveys scanned and added to the new online system. Realtors and appraisers along with some architects and lawyers will be the big winners as these property cards will now be online after the project is complete sometime in March.

“On the Gar system we’ll have some basic information like assessments and square footage,” said Assessor McEvily. “Anything that’s on the current system we have on the Gar system.”

Next After Scanned Cards

Once GAR is in place, the City will still be operating with the property cards as the core information asset, with the primary difference being the cards will be scanned and searchable by basic metadata. Next up the Assessor is looking at full automation. The company is negotiating with Tyler Technologies to more fully automate the assessor’s office. Rye PD recently contracted with Tyler to automate some of its systems including the incident reporting it uses to generate records provided to local media for police blotters. “We’re just in negotiations trying to work something out with them,” said Assessor McEvily. “It’s got to be funded.”

(note 1) Only In the case of new construction, where there has been a demolition of all previous improvements and a new house is built, can assessments be derived from the sale price. To estimate annual taxes on a newly constructed home, multiply the market value of $2,500,000 (sale price) x 1.47% (RAR) which results in an assessment of 36,750 and when multiplied by the 2022 City of Rye tax rate of $1,098.88 and divided by 1,000 equals annual taxes of $40,384.

(note 2) City assessments are fixed and were originally set in 1972, (the date of the last revaluation of all properties in Rye) and have only been changed when improvements are made that add to market value or there is a successful grievance that reduces market value. Assessments cannot be increased based upon a recent sale price; the assessment can only be lowered based upon a sale price. Currently, Rye City property assessments are only at 1.47% of the property’s full market value. Thus, current assessments are converted to a market value by dividing the current assessment by .0147 (equalization/residential assessment rate for 2022 is 1.47%). A property with an assessment of 30,135 is converted to a market value of $2,050,000, (the 2022 median market value for homes in Rye) by dividing the assessment by the residential assessment ratio (RAR). This is the same method for converting all City assessments to market value. The assessment is then multiplied by the tax rate and divided by 1,000 to derive annual property taxes. The assessment of 30,135 X $1,098.88 (the 2022 combined tax rate)/1,000 = $33,115 in annual real estate taxes including city, county and school rates. The residential assessment ratio (RAR) and equalization rate are currently the same. This rate is set annually by the New York State Office of Real Property Services and does change from year to year which impacts the market value of each property. Tax rates also change each year. It is the assessed value that is combined with the equalization rate (1.47% for 2022) that determines your annual property tax.

Honestly, this municipality should be embarrassed. They have not done a reevaluation for over 50 years! Having a 1.47 equalization rate is ridiculous. I can only imagine the immense inequities that exist in this tax roll.