Holding Court: Is Your Nanny Mary Poppins or Scary Poppins?

Holding Court is a series by retired Rye City Court Judge Joe Latwin. Latwin retired from the court in December 2022 after thirteen years of service to the City.

What topics do you want addressed by Judge Latwin? Tell us.

By Joe Latwin

Hiring an in-home Nanny or housekeeper?

It’s not that simple to hire a Nanny, caregiver or housekeeper and might be extremely costly. Mary Poppins just doesn’t come blowing in on an east wind. You must take many steps to protect yourself and comply with the law. There are several legal requirements that can put you in jeopardy. Just a spoonful of sugar will not keep the keep the IRS or New York State at bay.

Before you hire, you must verify the employee’s eligibility to work. This should entail using E-Verify, filling out a I-9 form and keeping a copy of the employee’s proof of citizenship or legal residency.

If you don’t already have one, you need to apply for an Employee Identification Number (“EIN”) from IRS. This will enable you to set up an account with state and federal tax authorities.

If it will be full-time employment (40+ hours/week or a live-in employee), you must get coverage for workers’ compensation insurance under Workers’ Compensation Law section 10. Time spent at the residence including sleeping and eating and any additional time spent off premises running errands and performing other duties for the employer count towards the total hours worked per week. For employees that work 20 or more hours per week, you must get Disability Insurance and provide paid family leave. A homeowner’s insurance policy’s workers’ compensation insurance rider does not cover any domestic employees for workers’ compensation benefits. Insurance Law §3420(j). Any employer who fails to keep required Workers’ Comp. records is guilty of a misdemeanor and subject to a fine of not less than five nor more than ten thousand dollars. Workers’ Comp. Law section 131.

You must provide all household employees with a wage notice (form LS 54) under Labor Law Section 195.1 at the time of hire, on an annual basis, and when there is a change in pay rate or payday. You must get written acknowledgement of the wage notice from the employee and keep it on file for six years. If an employee is not provided with this notice within ten business days of his or her first day of employment, he or she may recover damages of fifty dollars for each work day that the violations occurred or continue to occur, but not to exceed a total of five thousand dollars, together with costs and reasonable attorney’s fees in a civil action. Labor Law section 198 (1)(b). You must also post employee notice of rights posters and establish a sexual harassment prevention policy.

While not required by law, it would be good practice to have a written contract describing: what the employee must do, when they must do it, when work is to start, where the work is to be done, what the work schedule is, what the pay is, and when payday is, what additional payments may be made (e.g., reimbursement of expenses), vacation or other paid time off, holidays, tax withholding and reporting, restrictions on social media and photos, and grounds for termination,

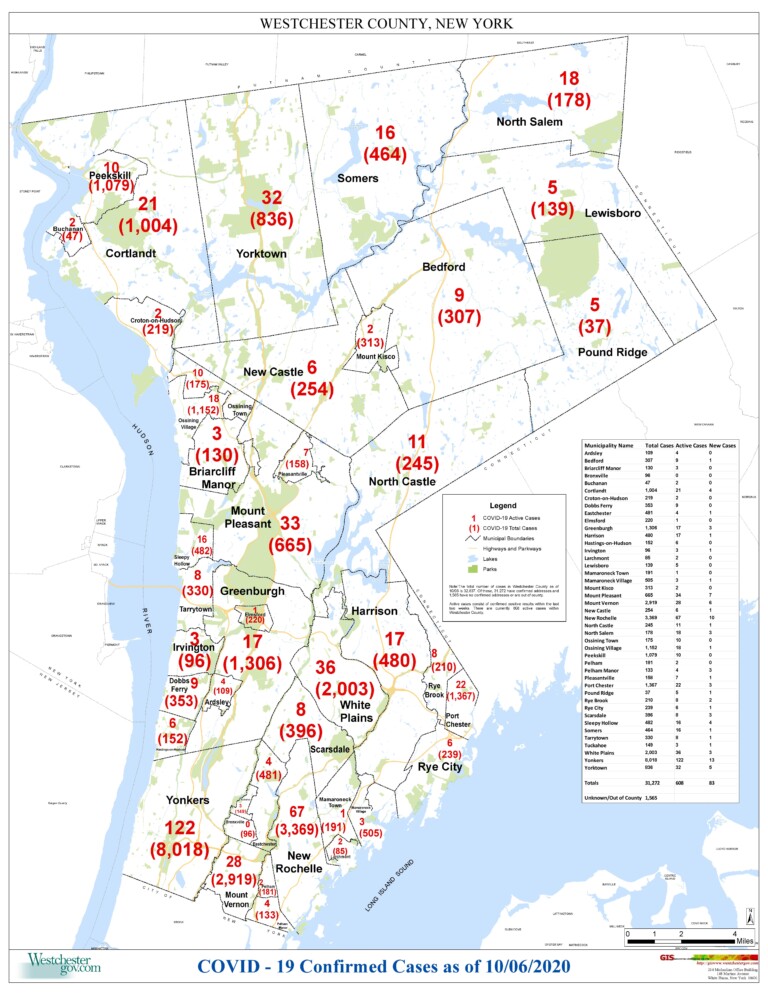

You must pay at least the minimum wage set by law. In Westchester, the current rate is $16 per hour and $18.55 for home health care aides. If the employee works more than 10 hours a day, the employee is entitled to an additional hour’s pay. If they work more than 40 hours in a week, additional hours above 40 must be paid at time and ½. Live in employees get time and ½ pay over 44 hours per week. There must be one day off per week. If you violate a wage provision of the Labor Law, for a first offense, you can be fined not less than five hundred nor more than twenty thousand dollars or be imprisoned for not more than one year. Labor Law section 198-A.

Under Labor Law section 192, wages must be paid in cash unless consent to direct deposit is previously made. No deduction from wages is permitted except for those set forth in Labor Law section 193 (taxes, pensions, charity contributions, U.S. bonds, labor dues, mass transportation passes, education expenses, and other employee benefits).

You must withhold Social Security & Medicare taxes (FICA) unless you file a Form Schedule H with your personal tax return where you will be responsible for reporting both the employer portion and the employee portions and paying the taxes on your personal return when it is filed. You must also pay federal and state unemployment insurance.

The employer must keep up to date payroll records of hours worked and provide the employee with a paystub each payday. These records must be kept for 6 years. If you fail to keep those records, you may be fined not less than five hundred nor more than five thousand dollars or imprisoned for not more than one year. Labor Law section 192.

Employees accrue sick leave. After a year, employees must get 3 days paid time off for working 30 or more hours per week. Westchester employers must give employees 40 hours of paid sick leave per year. Employees must be allowed 40 hours of paid leave per year if they have been victims of domestic violence or human trafficking.

While employers of household help need not withhold income taxes, they must provide the employee with a W-2 form by the end of January of the following year. You should not issue a nanny a Form 1099. Attempting to classify a nanny as an independent contractor by providing a Form 1099 is considered tax evasion by the IRS.

Employees are required to get a termination notice 5 working days before termination if they are fired or laid off.

There can be significant penalties for not complying with these requirements, some criminal. You may have to pay back taxes (Social Security, Medicare and unemployment insurance taxes), along with penalties and interest. In some cases, you could be charged with tax evasion and your professional license could be in jeopardy.

Tread carefully or you might get Scary Poppins!