City ’25 Budget Set at $52.8 Million

The City of Rye is setting a $52.8 million dollar budget for 2025, $1,844,028 over 2024. There will be a Council budget discussion on Wednesday evening at City Council. Also on deck is a public hearing on the budget on December 4th and a Council vote on the budget on December 18th.

Here is what you need to know:

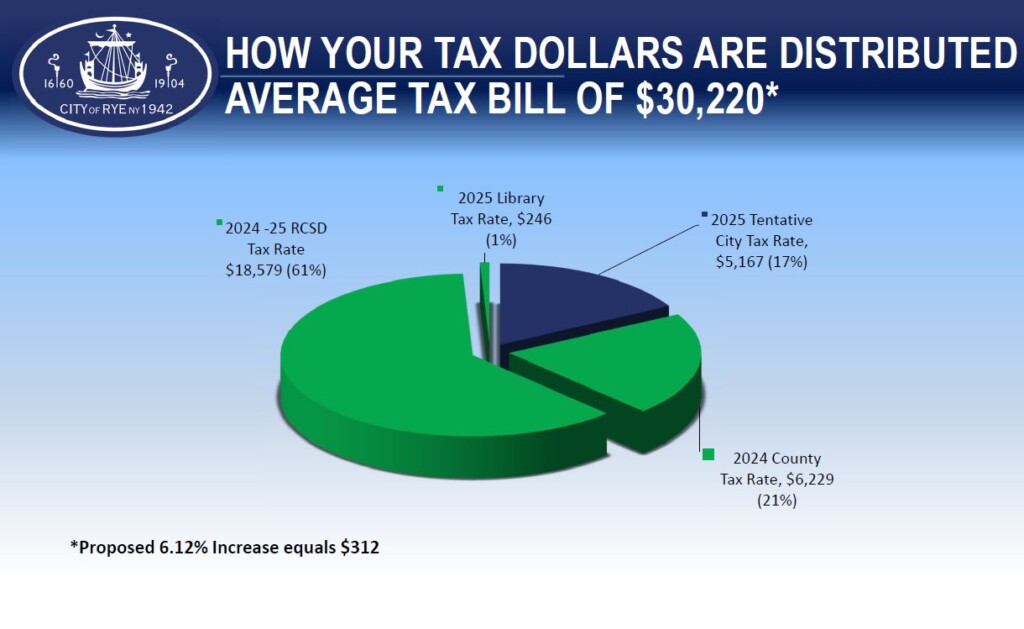

The budget represents a tax rate increase of 6.12%* or $312 for the average home in Rye. An average home is defined by officials as a $2 million dollar home. In dollars that is a City Tax Rate of $5,167. City taxes represent just 17% of an overall average tax bill of $30,220.

The $52.8 million is the general fund only and does not include other revenue the City generates (and spends) from bond proceeds, existing capital projects fund, State grants and State aid. The operating budget is funded completely out of tax revenues and other permit revenues.

| 2025 Budget | Amount |

| Total General Fund Expenditures | $52,779,009 |

| Sources: | |

| GF Revenues other than Property Taxes | $17,827,273 |

| Appropriated Fund Balance | $3,492,351 |

| Property Tax Levy | $31,459,385 |

| Levy calculation: | |

| Taxable Assessed Valuation | $145,321,645 |

| Tax Rate per $1,000 Assessed Valuation (2025) | $216.48 |

*4.22% excluding adjustment for the Playland tax mess

Advanced reading and watching:

- 2025 City of Rye Budget Presentation

- 2025 Budget Fact Sheet for public hearing

- City of Rye Citizens Budget Report FY 2025 (with actuals back to 2021)

Video: discussion of Rye, NY FY 2025 budget presentation by City Manager Greg Usry + City Comptroller Joe Fazzino on November 6, 2024: