Real Estate Update October 2008 – Making Sense of Rye’s Current Real Estate Environment

Single Family Homes (period ending 10/3/08):

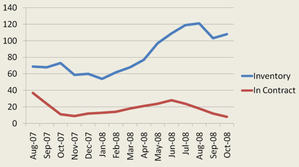

-On the Market 107

-In Contract 8

Shop Talk:

Seventy one homes have sold over the past six months in Rye City, compared to one hundred thirteen during the same period last year. Fifteen or 21.12% of these sales were under $1,000,000 with an average sales price of $800,000 and fifty six or 78.87% were over $1,000,000 with an average sales price of $2,238,491. By comparison, there are currently 169 homes on the market in Harrison, also 8 in contract – 44 have sold in the past six months for an average price of $2,023.920 where as 89 sold last year during the same time period for an average price of $1,921,978. So what does all this mean?

*zip 10580 RNSD & RCSD only. Harrison all zips in HCSD. 6 month period 4/3/08-10/3/08.

Making Sense of Rye’s Current Real Estate Environment

We certainly can’t underestimate the importance of the recent credit tightening and stock market losses and the effect that has had on home buying. As I mentioned in my October newsletter, until now, we have been somewhat insulated from the national housing crisis in this area, but the recent bank collapses and takeovers, coupled with the threat of higher unemployment and possible lack of bonuses in our Wall Street driven local economy, has created a standstill in many sectors of the housing market, especially at the high end. According to Rye resident Pat McCarthy of Manhattan Mortgage, "…at least 30% of the people that would have qualified over the past two or three years would not qualify today under the current guidelines, which are tighter throughout every aspect of the underwriting process."

We certainly can’t underestimate the importance of the recent credit tightening and stock market losses and the effect that has had on home buying. As I mentioned in my October newsletter, until now, we have been somewhat insulated from the national housing crisis in this area, but the recent bank collapses and takeovers, coupled with the threat of higher unemployment and possible lack of bonuses in our Wall Street driven local economy, has created a standstill in many sectors of the housing market, especially at the high end. According to Rye resident Pat McCarthy of Manhattan Mortgage, "…at least 30% of the people that would have qualified over the past two or three years would not qualify today under the current guidelines, which are tighter throughout every aspect of the underwriting process."

The benchmark of a high credit score cannot be underestimated and in this rapidly changing environment that can mean 760 and above. FHA loans are still readily available for those who do not meet this strict criteria, according to Andrew Feller of Coldwell Banker Home Loans, although they may carry higher upfront fees and longer processing time. As one of my clients pointed out, a buyer with $200,000 cash who may have been thinking last year of putting a 10% down payment on a $2,000,000 home may now be looking at a 20% down payment on a $1,100,000 house. Throw in the mansion tax, and some people are holding off, resulting in a steadily rising inventory first featured in our August post. The amount of inventory rose in the spring as is to be expected, but typically so do the amount of sales. This year that didn’t happen, although prices in Rye have held steady during this time period. The majority of buyers, even those who are cash ready, are looking for an element of stability in the finanacial markets before making offers. Many homes originally for sale, including luxury properties, have been rented instead.

What next? There is a return to the 3 C’s of lending: credit history, capacity (the depth and continuity of your resources), and collateral (the value of your property and your down payment or equity).* According to Carmen Wong Ulrich on CNBC’s new personal finance show, On the Money, if you qualify under the 3 C’s, there is an "economic silver lining"- you can take advantage of lower interest rates and plenty of inventory to choose from, putting qualified buyers in a great negotiating position for a home.

*"What it Takes to get a Mortgage Now" courtesy of Pat McCarthy.

![]() October 2008 Market Update and Article written by Judy Croughan, Licensed Realtor, Coldwell Banker, Rye.

October 2008 Market Update and Article written by Judy Croughan, Licensed Realtor, Coldwell Banker, Rye.