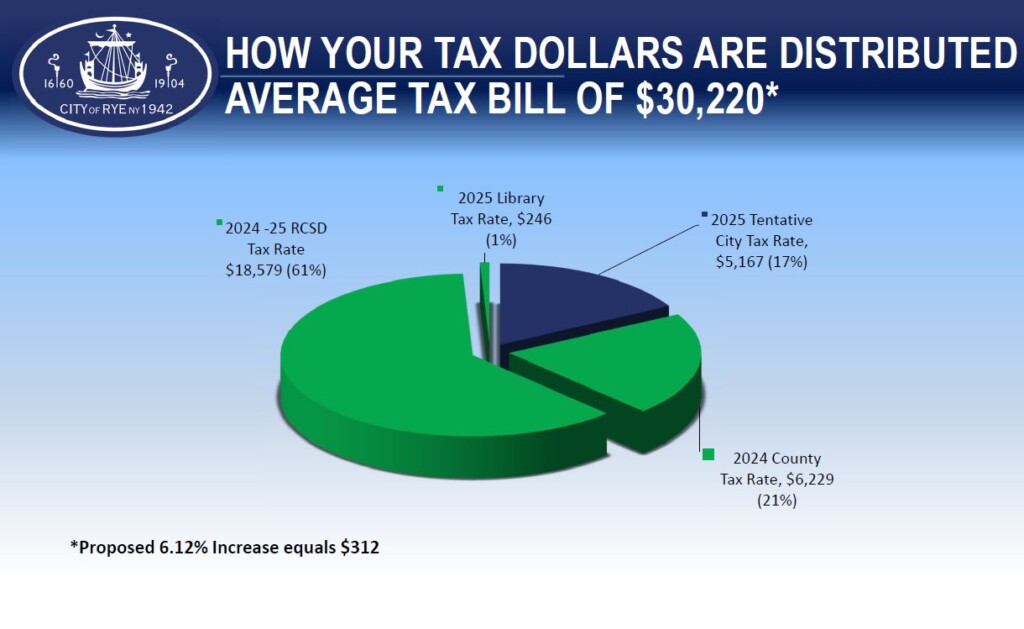

’25 City Budget Reflects 5.07% Tax Increase

The City of Rye’s 2025 budget – which City Manager Greg Usry and City Comptroller Joe Fazzino presented back on November 6, 2024 – was formally approved by the City Council on Wednesday evening during their last meeting of the year. The $53 million dollar budget reflects an adopted tax rate increase is 5.07% (3.19% excluding the impact of the Playland tax). Against the budget presented in November, there were some minor changes made Wednesday:

On December 4, prior to the opening of the Public Hearing:

- Reduction of General Fund Employee Health Insurance by $100,812

On December 18, after the opening of the Public Hearing:

- Reduction of General Fund Workers’ Compensation Insurance by $110,736

- Increase in Building Permit Revenue of $100,000

There was also a discussion of an increase in parking fees from $1.00 to $1.25/hour but no action taken. It is expected the Council will move forward on the parking fee modification as early as January after consulting with the Chamber of Commerce.