Rye Looking at Property Revaluation Tonight

Rye City will be reviewing a comprehensive city-wide property revaluation process at the city council meeting tonight. Revaluations are complicated and politically unpopular as they result in higher property taxes.

A presentation will be made to the council by by Government Policy and Research Committee – members are Susan Jansen, Pat McGunagle, Lizza Reyes-Clark and Matthew Thomas. Property taxes represent 53% of the City budget and about 90% of Rye City Schools budget.

Rye conducted its last assessment in 1972.

Property assessment are based on current market and are conducted by Rye City Assessor Noreen

Whitty. The assessor estimates the market value of real property using a number of accepted techniques. New York State does not require assessments to be listed at fair market value. Most Westchester municipalities carry their assessments at a small percentage of current market value. Rye, for the current assessment roll, is 2.16%.

As of 2009, there were 4,894 parcels in Rye

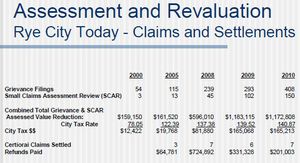

Grievance filings on assessments have steadily risen in recent years from:

54 in 2000

115 in 2005

239 in 2008

293 in 2009

408 in 2010

Small Claims Assessment Review (SCAR) cases have also increased from 3 in 2005 to 150 in 2010. You can see in the table above these various appeals resulted in assessment reductions of $1,172,808 and tax refunds paid to property owners of $201,003 in 2010.