City Presents $44M Budget; 5.24% Tax Rate Increase

The City of Rye presented it 2023 budget to the City Council on Wednesday.

Here is what you need to know:

Budget Summary:

- Tax Rate Increase of 5.24%

- 1.77% of total for street resurfacing and flood mitigation & resiliency

- Increase of $248 or $21 per Month for Average Home

- The tax levy increase for 2023 is $2,508,644 ($1,572,133 over the NYS Tax Cap)

- $3.1 million of General Fund Unassigned Fund Balance to Fund Capital Expenditures, Vehicle Purchases, PD radio system and Contingency Costs. (Non‐Operating Expenditures)

- $1.9 million proposed for street resurfacing

Next Steps & Key Dates for the 2023 Budget

- November 14th Budget Work Session – Rye Free Reading Room, Rye Recreation, Police Department, Fire Department

- November 16th Budget Work Session – Public Works, Boat Basin, Golf Club

- December 7th City Council Meeting (Public Hearing on Budget)

- December 21st City Council Meeting (Vote on 2023 Budget)

Your resources to understand the budget:

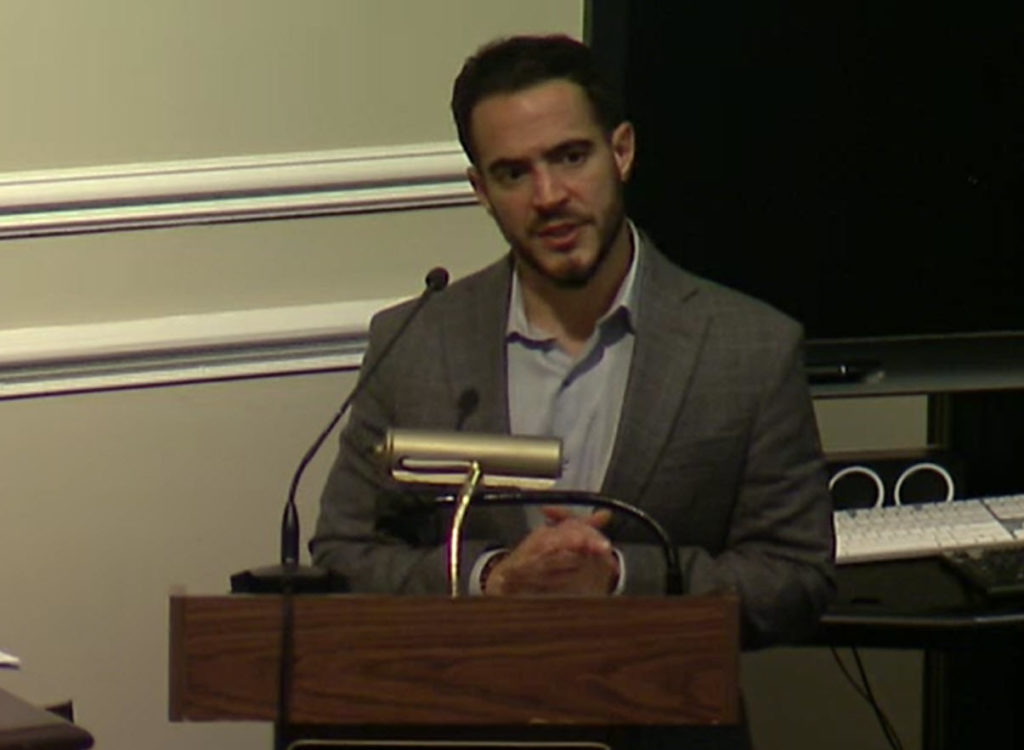

- City Manager Greg Usry letter on budget – see below.

- Video of City Manager Greg Usry and Acting Comptroller Joe Fazzino presenting the budget:

- City of Rye 2023 budget fact sheet

- City of Rye 2023 budget presentation

- City of Rye 2023 annual budget (tentative)

LETTER:

November 9, 2022

Honorable Mayor Cohn and City Council Members City of Rye

1051 Boston Post Road Rye, New York 10580

Dear Mayor and Council Members:

Submitted here, for your review and consideration, is the City Manager’s recommended 2023 budget. The proposed operating budget is $44,387,612 and will require a real property tax rate of $200.85 or 5.24% increase over 2022. For the second year in a row, the New York State Inflation Factor is greater than the New York State Tax Cap of 2%. As explained further below, the current inflationary environment, combined with the cap calculation causes this budget to exceed the Tax Cap.

For the past three years, the City has proactively addressed the financial and economic factors caused by the pandemic. In my budget message last year, I noted that for the first time since 2019 I expected the 2022 budget to be a return to a more typical year, both in terms of revenues and expenses. This year was, in fact, a return to “normal.” As we came out of the pandemic, our conservative budgeting and focused spending resulted in financial over-performance; said differently we were able to continue to provide all resident services while accumulating an impressive fund balance for our capital projects program. This was all done while keeping property tax increases to a five-year average of 2.6%.

However, current inflation and forecasts for 2023 and beyond are painting a very different picture. Inflation is now at a 40-year high. With year-end inflation projections reaching or exceeding 8%, the City’s budget is under pressure. While we can control some expenses, the discretionary portion of our operating budget is limited.

This budget is not within the New York State Tax Cap formula, and will require the Council to first adopt a local law to override the State enacted tax levy limitation by a vote of 60% of the City Council (5 out of 7 members) and then, by a majority vote of the Council adopt the budget.

Although aspirational for the 2023 budget, it is not practical to limit growth to 2% given the following:

- New York State Tax Cap Inflation Factor of 17% (real GNP growth projected higher)

- Estimated costs of materials and supplies up 6-20%

- Projected insurance expenses up 10%

- Salary, benefits and taxes up 3-10%

- Projected decline in non-property tax revenues (Building Permits, Mortgage Tax, Sales Tax)

With that said, the goal of this budget is to maintain our current level of services, meet our ongoing need to invest in critical infrastructure and to further the stated goals of the Council, all while minimizing the property tax impact to City residents. The current inflationary environment, combined with continuing sound financial planning, does necessitate the 5.24% increase for 2023. I am keenly aware of the economic concerns of our residents, and believe this budget reflects a responsible approach to City operations and long-term investment.

This budget is a continuation of sound financial planning from prior budgets. As part of the total overall tax increase, this budget includes an increase of 1.77% for street resurfacing and to address costs related to flood mitigation and resiliency. These are critical for long term financial and operational stability.

Finally, the budget does include some recommended use of fund balance. As in past years, this is only for capital reinvestment and does not supplement the operating budget, nor does it affect the tax rate in any way. Rather, it supports this Council’s historic reinvestment in City roads, infrastructure, recreation facilities and the vehicle fleet. The source of the excess fund balance and its use is highlighted below. It should also be reviewed in the context of the Capital Projects Finance Plan which was presented to the Council in August. That plan, dated August 4, 2022 is incorporated herein by reference.

As I have noted each year since 2019, Rye is extraordinarily fortunate relative to many other communities in the County and throughout the region. That was reinforced throughout the pandemic, and I believe it will be the same as we navigate this new financial environment. We have been able to pivot and modify operations to preserve our financial strength. This could not have been accomplished without Council and community support.

Below, and on the following pages, you will find highlights for the proposed budget, as well as rationale for the tax increase, including revenue assumptions and expense budgets.

Budget Highlights

Staffing

Representing 66% of the total operating budget, staffing is an ongoing focus. In late 2022, we experienced several senior level staff retirements. I do expect some minimal cost savings as we work to quickly fill these vacancies, and to further backfill in consideration of several promotions.

As noted in the last two budgets, our Fire Department command staffing is well underway and continues to produce both financial and operational efficiencies. However, in the short run we will experience some additional overtime due to training, FLIP school and fire inspection training. The proposed budget includes this cost. On a positive note we have now filled all outstanding positions at the Police

Department for the first time in five years. Furthermore, the addition of both the Public Safety Commissioner and Assistant City Manager has had a significant impact on administrative operations.

One remaining area of focus is the Building Department, and the transition to a new Building Inspector this month. Construction and land use in Rye is increasingly time intensive and expensive and we continue to evolve our approach in how we serve our residents.

The 2023 proposed budget assumes all positions are filled. A detailed summary of staffing by department may be found on page 12-3 of this document. The difference between unfilled and budgeted positions simply reflects the timing of the budget. We do expect to fill all open positions.

Salaries, Wages and Benefits

Salaries, wages and benefits each year are impacted by a number of factors including overall staffing levels, contract pay increases, State determined retiree benefits, medical insurance costs, and workers’ compensation costs. For 2023, we are budgeting an increase of $1.76 million (6.2%). Changes in salaries reflect contracted increases for each union. All union contracts expire at the end of 2023. Health insurance for both employees and retirees assumes a 10% increase over 2022 insurance premiums.

Police and Fire overtime expenses remain an important focus as we balance public safety need with sound financial planning and management. 2022 was an active year for utility work in the City, and our PD overtime reimbursement had positive implications on the overall overtime budget. In 2023, we will be further refining our reimbursement rates. Our actual PD overtime cost increased the latter half of 2022, as we provided additional police presence and training in response to the Uvalde shooting. We also incurred some additional cost related to the establishment and training of the Swift Water Rescue Team (combined FD and PD).

Materials and Supplies

Certain material costs have doubled in the course of this year, and the 2023 budget reflects an overall increase in excess of 17% or $580k. The largest driver of this increase relates to fuel and energy expenses.

Debt Service

In February the City borrowed $13.55 million at an all-in interest rate of 3.01% (compared to a current estimated rate of 4.70% and an estimated savings to the City of over $250k) as a funding component of the capital plan for City infrastructure. The average annual debt service cost during the 25-year term of the bonds is approximately $880,000. This annual cost is reflected in the budget.

Legal Expenses

The 2023 proposed budget reflects an increase of $120,000 or 29% for legal expenses. This is reflective of ongoing legal matters across City Departments, Council initiatives as well as the contemplated union contract negotiations.

Port Chester-Rye-Rye Brook EMS

As a stand-alone 501(c)3, the PC-R-RB EMS contracts with the three communities to provide critical EMS service. The City’s contribution for 2023 totals $354,360 or approximately $75 per household. The amount included in this budget is an increase of $76,652 over 2022 and reflects both inflationary impacts, as well as increased staffing and supervision in light of the community supported comprehensive study this year.

Rye Free Reading Room and Rye Youth Council

The Rye Free Reading room has requested $1.36 million for 2023, an increase of $25k or 1.8% over 2022. The Rye Youth Council has requested an increase of $5,000 or 8% for 2023. This is the first increase in two years. These requested amounts are included in this proposed budget.

Significant Non Property Tax Revenues

Sales Tax, Mortgage Recording Tax and Building Permits total $7.2 million or 16% of the total operating budget. Over the past six years, the City has benefitted from increasing revenues, reflective of low inflation and a growing economy. With the accelerating inflationary environment, and resulting economic slow-down, we must assume some contracting of these revenues.

Sales Tax is a key component of the City’s annual budget, representing approximately 24.9% of total, non-property tax revenues and 8.5% of total revenues. Our 2020 mid-year adjusted budget, as well as our 2021 budget was conservative, reflecting the impact of the pandemic. For 2022, we were more comfortable budgeting higher based upon a normalized year and assumed $3.8 million in sales tax revenues. This is in line with expected results for this year. For the 2023 budget, we are projecting a slight decline in sales tax revenues versus projected 2022 receipts.

Mortgage Recording Tax is approximately 11.5% of our non-property tax revenues and 3.9% of total revenues. Over the last five years mortgage taxes have totaled $1.6 – $2.5 million annually. For 2022 we are projecting $2.52 million or $770k over our budget. With mortgage rates now surpassing 7%, the highest since 2002, we are projecting lower mortgage activity and a resulting budget assumption of

$1.75 million for 2023 (a 30% reduction versus projected 2022 results).

Building Permit revenue for 2022 is expected to meet the budget of $1.8 million. Similar to sales tax and mortgage tax, we are assuming that there will be a slowing of new building activity in 2023. We are budgeting a reduction of $150k for the 2023 budget (an 8% decline).

Interest Income results from the various City funds that are invested per the City’s Investment Policy. Over the past few years historically low interest rates resulted in a dramatic decline in interest income. As a result of Federal Reserve action since May short-term interest rates have risen over 3%. This dramatic increase, coupled with the significant additional monies invested in anticipation of our capital program (bond proceeds and Capital Project Fund), provides significantly greater assumed interest income for 2023. For this budget we are assuming interest income of $800k versus $50k in the 2022 budget.

Budgets In Brief

General Fund

This is the principal fund of the City and includes all operations not required by law or policy to be recorded in other funds. The 2023 General Fund Budget is $48,087,612. $44,387,612 of this amount is operating expenditures, up $3,718,662 (9.1%) over the 2022 adopted budget. The proposed property tax rate is $200.85 per $1,000 of assessed valuation. The property tax levy of $29,700,818 equals 61.7% of General Fund appropriations.

With this proposed budget, I am recommending that a portion of the excess General Fund unassigned fund balance be utilized for certain long term capital investments (non-operating uses), as well as to replenish the Contingency Reserve Fund. Based upon the City’s General Fund policy of maintaining a reserve equal to 10% of projected expenses, there is a projected $2.625 million excess fund balance. These surplus monies were generated by a combination of FEMA reimbursements for storm damage, over-performance in certain revenue categories and savings in some expense areas:

- FEMA Reimbursement – $1.04 million from damage and City expenses related to Isaias and Ida

- Sales Tax Revenue – $400k greater than 2022 budget

- Penalties and Interest – $250k greater than 2022 budget

- Mortgage Recording Taxes – $770k greater than 2022 budget

For 2022, I am recommending the following transfer and use of surplus monies:

- $350,000 for the replenishment of the Contingency Reserve Fund

- $225,000 for additional costs related to the PD Radio System (Metro North)

- $400,000 for City vehicles

- $1,6500,000 for the Capital Projects Reserve Fund

Contingency Reserve Fund

The City maintains a Contingency Reserve Fund for unanticipated expenses. In some years the fund is not drawn upon, or only to a minor degree. For 2022, we utilized $336k of the Contingency fund ($200k to cover inflated fuel prices; $26k for the Federal Channel markers; $100k for DCMC-FEMA Consultant and $10,000 related to the Verizon settlement). With this budget I am recommending that we replenish the Contingency Fund with $350k from 2022 surplus monies.

Police Radio System

By Council action in June, $600k from 2021 surplus monies was transferred for the purchase of a new communication system for the Police Department. This is the first system replacement in approximately 20 years and is required for all PD operations, as well as coordination/communication with surrounding municipalities. Unfortunately, cost estimates provided by vendors and the system sponsor fell well short of the actual cost of $925k. With this budget I am requesting an additional $225k from the projected 2022 surplus to complete the new system acquisition. The remaining $100k shortfall will be funded from Department of Defense 1033 funds held by the City.

Building and Vehicle Maintenance Fund

This fund is responsible for costs of maintaining and operating the City’s buildings and acquiring and maintaining vehicle fleet. In addition to the annual replacement of police cars and DPW equipment, the City requires larger purchases on a less regular basis (Fire apparatus, DPW trucks, PD Marine Patrol boat etc.). These replacements are predictable based upon forecasted use/depreciation and should be proactively funded.

Beginning with the 2022 budget we established the first City Fleet Management Plan. Through that plan we estimate that the annual cost of replacements totals approximately $1.2 million (including annual fleet purchases and longer term investment on larger fleet items).

The 2022 budget included $400k in the tax rate for fleet investment, as well as a one-time use of fund balance of $1.6 million. At the time I noted that this amount was only the first step and that there would be additional needs. We estimate the annual fleet needs of Public Safety and DPW total $800k, without the larger fleet investments. For that reason I am recommending an additional $400k in excess fund balance be allocated to the BVM Fund (totaling $800k for 2023 – $400k in the tax rate and $400k fund balance). In future years I recommend additional monies be included in the tax rate as a matter of sound financial planning.

Capital Projects Fund

In recent years, the City’s financial performance has allowed us to increase the Capital Projects Fund in anticipation of the significant infrastructure investment. By Council action in 2019, the General Fund unassigned fund balance was set by policy at 10% of total expenses. Furthermore, a Capital Projects Fund was established with excess General Fund reserve monies (over the 10% policy along with single, non-reoccurring significant revenues). .

At 2021 year end, the Capital Projects Fund totaled $7.265 million. In July we received the second half of the Federal ARPA monies totaling $805k and by earlier Council action this was appropriated to the Fund. In February the Council allocated $350k of fund balance for Ramboll Engineering (Blind Brook watershed study and plans). This brings the current Fund balance to $7.72mm. As part of this budget, and in keeping with the previous Council policy I am recommending that $1.65mm of the projected 2022 budget surplus be directed to the Capital Projects Fund. In total we expect a Capital Projects Fund balance of $9.37million for 2023. These monies are an important aspect of the City’s identified $45 million capital program.

Flood Mitigation and Resiliency

In the aftermath of Ida, this Council and City staff have invested significant money and time on the issue of flooding. In 2022, the City spent approximately $450k on engineering studies and financial consultants related to the Blind Brook watershed. In addition, the City has spent an estimated $150k of additional monies on engineering design and work to alleviate localized flooding caused by an aging storm water infrastructure system.

This is likely to be only the beginning of a longer term investment by the City in flood mitigation and resiliency-coastal/tidal, riverine and localized flood issues. In this budget, I am proposing that $250k be added to the tax rate to be dedicated to flood mitigation and resiliency. This initial $250k funding will be partially used to fund the annual collection of data and maintenance of the stream gauges on the Blind Brook over the next 3-5 years, estimated to cost $150k annually

Street Resurfacing

Since 2018 the City has spent over $9 million on resurfacing roads, and has paved 34 lane miles of roads throughout the City. This work, combined with the repaving done by utilities and Westchester County, has resulted in significantly improved road conditions. In recognition of the ongoing need to properly maintain our roads I am proposing an additional $250k to be added to the tax levy, dedicated to roads. This amount combined with the existing $600k levy and the estimated $100k in annual street opening permits assures an annual investment of approximately $950k.

For 2023 we expect to resurface Purchase Street and undertake significant repairs to both the Rye Rec and the Rye Art Center parking lots. For the 2023 budget I am recommending the use of the following funds for resurfacing:

| NY State Extreme Weather Recovery | $161,000 |

| Pave New York | $116,000 |

| NY State Touring Route | $675,000 |

In total, the combination of tax rate, permit revenues and other funds total $1.9 million for City roads and parking lots in 2023.

Sewer Maintenance

In February of 2021, the City settled its longstanding suit with Save the Sound (STS), agreeing to a set of sanitary sewer infrastructure improvements, and committing itself to ongoing maintenance and monitoring of the system. The terms of the settlement required that this cost be included in the annual budget. Annual costs related to our City-wide sewer maintenance total approximately $500k and are found in the DPW annual budget. In addition, as required by the terms of the settlement and stipulated order we are investing an additional $150k annually in various sewer repairs and improvements. The total annual cost of sewer maintenance (including this additional amount) totals approximately $650,000).

Boat Basin Enterprise Fund

This fund is responsible for the operation and maintenance of the DePauw Municipal Boat Basin. Revenues for 2023 are forecasted to be $902,900, with budgeted expenses (less depreciation) of

$714,712. For year-end 2023, the Boat Basin has estimated unrestricted net assets of $3.3 million. It is expected that a significant part of this fund balance will be used to compete the dredge of the Basin in Fall of 2023.

Rye Golf Club Enterprise Fund

The RGC Enterprise Fund is responsible for the operation and maintenance of the Rye Golf Club. For 2023, revenues are forecasted to be $5,496,500, with budgeted expenses (less depreciation) of

$5,438,931. For 2023, the Golf Club has estimated unrestricted net assets of $3.8 million.

Rye Town Park

The City of Rye is responsible for 39.3% of any operating loss at Rye Town Park. The Park’s finances were impacted by COVID in the last few years. For 2022, operations returned to a more typical season. Going forward we expect Park revenues to cover operations. In addition, the Rye Town Park Commission is continuing to review capital needs and apply for grants. For the 2023 proposed budget, there is $50k included for RTP. Any additional operational or capital expenses requested by the RTP Commission would be funded from other funds (Capital Projects Fund, Contingency Fund etc.).

Conclusion

As we approach 2023, the current economic environment and inflationary pressures cause us to be even more mindful and deliberate in how we allocate our resources. This proposed budget reflects the Council’s policies, resident and visitor expectations for services and sound financial planning. The budgeting and pla1ming that began several years ago is showing positive results. The 2023 budget is a continuation of that pla1ming, as well as being responsive to the renewed attention to flooding and emergency preparedness.

During the pandemic, the City administration remained focused on the dynamic financial impacts and made timely and necessary adjustments. This active financial management proved to be critical over the last three years, and will continue in 2023.

Although this proposed budget is not tax cap compliant, it is reflective of conservative budgeting and a critical review of all revenue and expense items. In order to accomplish this, Department Heads and the City Comptroller looked critically at every aspect of City operations and expenses. We do not take the financial responsibility entrusted in us lightly.

By the Charter, it is the obligation of the City Manager to submit the budget to the Council for your consideration. However, this budget, like all City operations, is the result of the collective work of each Department Head. My thanks to each for this work, and for the conscientious work every day. As always, Joe Fazzino and his staff have done the heavy lifting to produce this budget and financial plan.

Respectfully submitted,

Greg Usry

City Manager

1. Will the new city vehicles be electric to reduce pollution?

2. Pollution from gas leaf blowers and lawnmowers in California “emit more air pollutants statewide than California’s 14 million cars” and more than 100 cities according to National Wildlife Federation (Oct/Now 2022 magazine p.13) have outlawed gas leaf blowers.

3. When will sidewalks be put in on Forest Ave? There are accidents waiting to happen.

4. When will Rye ban use of plastic bags? Save the Sound reports plastic is polluting our water ways.

5. When is Rye going to ban all purchase of and use of assault rifles and require registration of all such rifles now owned in Rye?