NY State Comptroller Says Rye “Healthy Financially”

New York State Comptroller Thomas P. DiNapoli has issued a report saying Rye City and nearby White Plains are "Faring Better Than Most Cities". What do you think? Leave a comment below.

The news release + report below:

The cities of White Plains and Rye in Westchester County continue to maintain healthy financial positions due to stable tax bases, low poverty and conservative budgeting, according to reports issued today by State Comptroller Thomas P. DiNapoli. The reports are part of a series of fiscal profiles on municipalities across the state.

“White Plains and Rye are on solid financial ground and not facing the demographic and fiscal stress challenges that are afflicting other cities in New York,” said DiNapoli. “By taking advantage of these favorable circumstances, each municipality has been able to encourage economic development and cultivate financial stability for residents and taxpayers. To maintain these positive conditions, I urge city officials to continue to budget prudently and remain vigilant when it comes to long-term financial planning.”

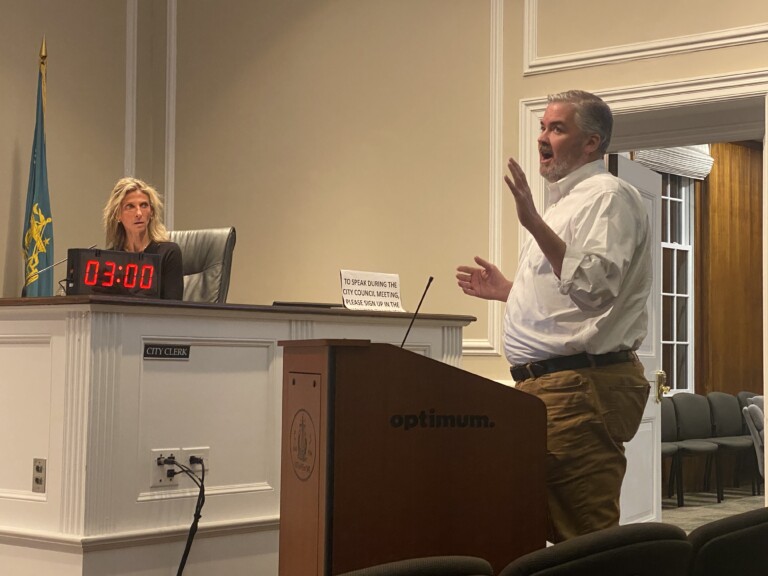

“Rye is a small city, but the recession hit us equally hard five years ago when our financial trend lines were going in the wrong direction – rising unemployment, declining fund balance, rising pension and health care costs, and declining infrastructure funds,” said Rye Mayor Douglas French. “Despite the challenges posed by the property tax cap, the city's focus on sound fiscal decision-making and tough budget choices has put Rye in excellent position as the economy rebounds.”

“Since becoming mayor, my focus has been on stabilizing taxes and running a more efficient government,” said White Plains Mayor Thomas Roach. “The city of White Plains has stayed within the state property tax cap and has not borrowed to pay for pension costs or other operating expenditures and has ceased the practice of borrowing for tax certiorari. We have consolidated departments and services and are continuing to look for efficiencies and other cost-sharing opportunities. We are on the right track and I am pleased that this profile by the Comptroller recognizes that.”

Over the past decade, expenditures in each city have grown faster than the statewide average, according to the reports. The Comptroller noted, however, revenues have increased substantially for both municipalities during the same time frame. In Rye, revenues increased 5.7 percent while expenditures grew by 5.9 percent. In White Plains, the city’s revenues increased 4.5 percent and expenditures by 5.1 percent. The statewide average growth for cities in each of these categories was 3.3 percent for revenues and 3.6 percent for expenditures.

Revenue growth has allowed each city to build up its rainy day reserves. In 2012, Rye had $6.8 million in available fund balance, equal to 23 percent of its general fund expenditures, and White Plains had $12.7 million available, or 9.2 percent of its expenditures.

The fiscal profiles also outlined several positive demographic factors that benefit each city.

For example, Rye’s median home value is more than $1 million, which is ranked highest in New York state. The median household income of $142,469 is substantially higher than the median of $38,699 for cities statewide. And the child poverty rate was a mere 1 percent, compared to 28 percent for the median city.

This combination of factors allows Rye to rely more heavily on property taxes to fund operations than most other cities. In 2011, property taxes accounted for 46.2 percent of Rye’s revenues, which was notably higher than the 27.1 percent of revenue for all cities in the state.

In White Plains, there are a number of similar positive economic indicators. The city’s median household income is $76,164; the median home value is $518,500; and the child poverty rate is 13.6 percent. White Plains also outperformed most cities in each of these categories.

White Plains, however, has encountered some fiscal challenges in recent years. Notably, the city’s property values fell 29 percent between 2008 and 2013 due to the real estate market collapse. As a result, city officials have implemented a number of cost-saving measures designed to offset losses in revenue, including the consolidation of administrative functions, workforce reductions, wage freezes and additional reductions in operations.

DiNapoli’s fiscal profiles of the cities also highlighted:

- Rye’s revenues grew 69 percent between 2001 and 2011 while White Plains’ revenues grew 55 percent during the same period;

- Rye generated 26 percent of its revenue through service fees in 2011, higher than the statewide average of 21 percent;

- White Plains received 31 percent of its revenue through sales tax in 2011, compared to the statewide average of 21 percent; and

- From 2000 through 2010, the population of Rye increased 5 percent while the population of White Plains increased 7 percent.

DiNapoli has issued more than a dozen profiles on municipalities across the state. As part of this effort, DiNapoli will also release in-depth reports on some of the issues that contribute to the financial pressures on local governments.

Earlier this year, DiNapoli implemented an early warning system that gives local communities a fiscal stress score. Under his Fiscal Stress Monitoring System, DiNapoli identified 40 counties, cities and towns with fiscal years that coincide with the calendar year that are in fiscal stress. DiNapoli will issue additional fiscal stress updates for other local governments with different fiscal years on an ongoing basis.

DiNapoli’s system evaluates local governments on nine financial indicators and creates an overall fiscal stress score. Indicators include fund balance, cash-on-hand and patterns of operating deficits. The scores are used to classify a local community as being in “significant fiscal stress,” “moderate fiscal stress,” “susceptible to fiscal stress” and “no designation.” The system also evaluates communities relative to 14 environmental stress factors such as population trends, poverty rates and property values.

Download a copy of the Rye fiscal profile.